Liquidity Trap: 7 Shocking Facts You Can’t Ignore

The liquidity trap is a critical economic phenomenon that has increasingly impacted Mauritius’s financial landscape in recent years. It refers to a situation where monetary policy becomes ineffective because interest rates are close to zero, and investors prefer holding cash over investing or spending, causing economic stagnation. For Mauritius, this has translated into serious challenges in maintaining financial stability and ensuring sustainable growth. This article explores seven shocking facts about the liquidity trap you can’t ignore, highlighting its causes, consequences, and the urgent need for strategic interventions.

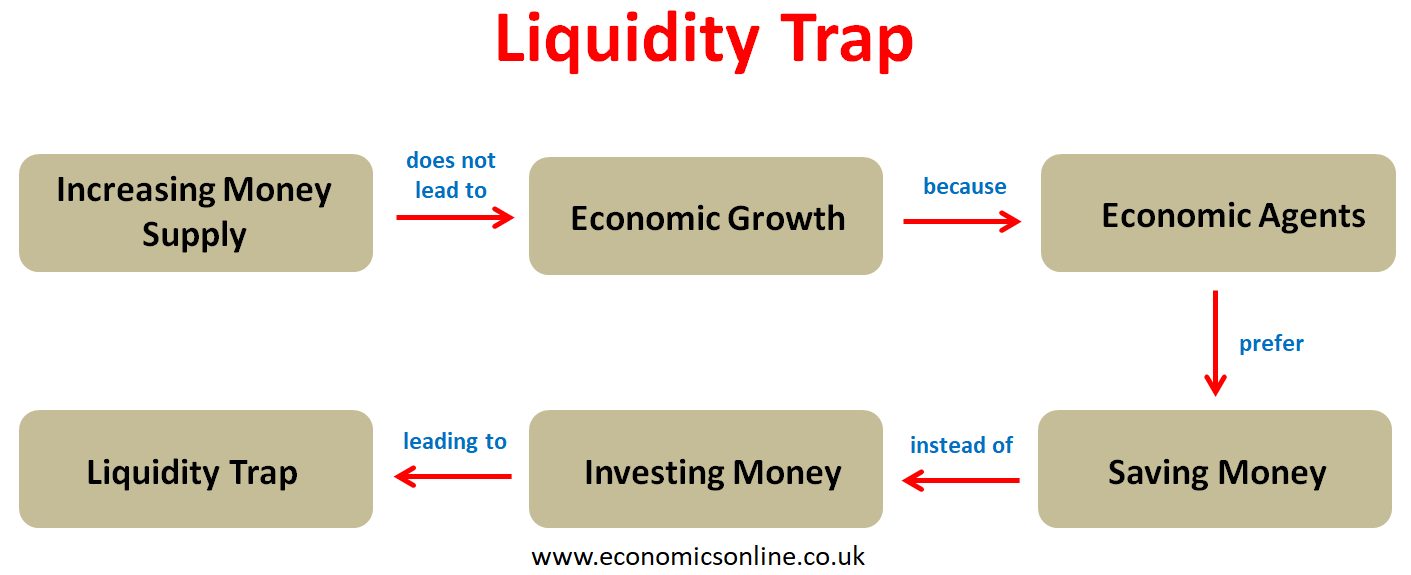

What Is the Liquidity Trap and Why It Matters

A liquidity trap occurs when central banks lose their ability to stimulate the economy through conventional monetary policy. In Mauritius, the Bank of Mauritius has faced this dilemma, especially when efforts to inject liquidity into the banking system failed to translate into increased lending or economic activity. This phenomenon is particularly alarming because it signals a deeper loss of confidence among investors and consumers. When money is hoarded rather than circulated, economic growth slows dramatically, undermining job creation and overall development.

The liquidity trap also poses risks to government fiscal policies, which may struggle to compensate for stagnant monetary policy. In a small and open economy like Mauritius, these effects ripple through various sectors, including tourism, manufacturing, and financial services. Understanding the liquidity trap is thus essential for policymakers, investors, and the public to grasp why immediate and innovative responses are necessary.

:max_bytes(150000):strip_icc():format(webp)/liquiditytrap.asp_Final-6590b33aa8b54861871f159ddcbf8aac.png)

1. The BoM’s Controversial Rs 4 Billion Liquidity Injection

One of the most debated actions taken to address the liquidity trap was the Bank of Mauritius’s decision to inject Rs 4 billion into a troubled financial group under administration. This liquidity injection was backed by shares in a foreign company that some experts considered overvalued, raising concerns about the adequacy and prudence of the collateral. The move was unprecedented and contrasted sharply with the earlier refusal to save Bramer Bank, which failed to raise Rs 350 million in liquidity.

This disparity in treatment has stirred controversy over regulatory consistency and transparency. Critics argue that the BoM’s liquidity injection, though aimed at stabilizing the sector, may have set risky precedents. Meanwhile, supporters contend it was a necessary intervention to prevent a broader financial collapse. The liquidity trap context adds complexity to these decisions, as conventional tools were inadequate, forcing policymakers into uncharted territory.

The Rs 4 billion injection also sheds light on the delicate interplay between the central bank’s mandate, government influence, and the legal framework guiding financial operations. How these factors will evolve remains a key question for Mauritius’s economic future.

Understanding the Regulatory Boundaries

According to Section 9(1)(d) of the Bank of Mauritius Act 2004, the central bank is prohibited from granting loans secured by shares, given their high volatility. Despite this, the recent liquidity support was reportedly granted against shares of Britam Ltd., a Kenyan company, creating a legal gray area. This suggests that the government may have exerted influence to override statutory restrictions in the name of financial stability.

Such exceptions, while potentially necessary in crisis situations, raise important questions about the balance of power and the risks of setting dangerous precedents. Investors and analysts now closely watch how future liquidity support measures will be structured within the constraints of existing laws and evolving economic realities.

2. The Domino Effect: How the Bramer Bank Collapse Triggered BAI’s Downfall

The revocation of Bramer Bank’s license by the Bank of Mauritius in April 2015 marked the beginning of a financial domino effect. The inability of Bramer Bank to meet liquidity requirements triggered its collapse, which subsequently dragged down the British American Insurance (BAI) group. This sequence of events exposed the interconnectedness of financial institutions and the vulnerabilities within Mauritius’s banking sector.

The liquidity trap played a significant role in exacerbating these failures. With cash hoarding prevailing, the banking system faced severe liquidity shortages, impairing its capacity to meet obligations and maintain public confidence. The collapse not only affected shareholders and employees but also led to uncertainty among the general public and foreign investors.

This episode illustrated how liquidity issues in one part of the financial system could cascade, affecting broader economic sectors and raising systemic risk concerns. Addressing the liquidity trap is therefore not just a monetary challenge but a systemic priority.

The Human Impact: Employees and Policyholders in Crisis

The collapse severely affected thousands of employees who lost jobs and policyholders who feared losing their insurance payouts. The government had to step in to assure holders of the Super Cash Back Gold (SCBG) policies that they would be compensated fully by mid-2015. These assurances were crucial in calming public fears but also imposed significant financial burdens on the government.

The liquidity trap’s persistence threatens similar crises in the future, highlighting the need for stronger financial safeguards and better crisis management frameworks. The human cost of financial instability reinforces the urgency of breaking free from the trap.

3. Why Mauritius Faces a Unique Liquidity Trap Challenge

Mauritius’s status as a small, open economy with significant exposure to global markets makes it especially vulnerable to liquidity traps. External shocks such as fluctuations in foreign direct investment or tourism revenues can quickly lead to cash hoarding and reduced economic activity. This fragility requires tailored policy responses that go beyond standard monetary tools.

The liquidity trap is compounded by limited fiscal space and the challenge of maintaining investor confidence in a competitive global environment. Thus, Mauritius must innovate by strengthening its financial institutions, enhancing transparency, and promoting economic diversification to mitigate these risks effectively.

4. Policy Responses: The BoM’s Struggle to Maintain Stability

The Bank of Mauritius’s struggle to balance regulatory mandates with the need for liquidity support highlights the complexity of managing the liquidity trap. Its refusal to extend certain advances beyond regulatory limits reflects a cautious approach, while government capital injections suggest a willingness to intervene more aggressively.

This delicate balancing act requires the BoM to evolve its crisis management capabilities, possibly adopting unconventional monetary policies and strengthening coordination with fiscal authorities. The central bank’s future role will be pivotal in ensuring Mauritius can navigate out of the liquidity trap.

International experiences, such as Japan’s long-term liquidity trap or recent measures by the European Central Bank, offer valuable lessons for Mauritius. However, local context must guide policy adaptations.

Lessons From International Examples

Countries that have faced liquidity traps often resorted to non-traditional policies like quantitative easing, negative interest rates, or targeted fiscal stimulus to revive economic activity. Mauritius can study these examples while crafting its unique solutions, considering its economic size, structure, and institutional capabilities.

5. The Legal Controversy Surrounding Liquidity Support

The granting of liquidity support against shares challenges established legal frameworks and raises important governance questions. The Bank of Mauritius Act’s prohibition on lending against shares aims to protect the financial system from excessive risk. The recent Rs 4 billion facility, however, tested this principle under exceptional circumstances.

This legal controversy underscores the tension between strict adherence to laws and the pragmatic needs of crisis management. Transparent explanations from regulators and policymakers will be essential to maintain public trust and avoid undermining the rule of law.

6. The Role of Government and Financial Regulators

The government’s role in approving liquidity injections and appointing special administrators for troubled institutions illustrates a proactive approach to stabilizing the financial system. The Financial Services Commission has played a critical role in managing the administration of collapsed entities, aiming to protect stakeholders and restore confidence.

Such coordination between government bodies and regulatory agencies is vital to navigate the liquidity trap’s complex challenges. It also highlights the importance of good governance and clear accountability in crisis situations.

7. What the Future Holds: Breaking Free From the Liquidity Trap

Breaking free from the liquidity trap will require Mauritius to undertake comprehensive reforms, including updating legal frameworks, improving transparency, and boosting economic resilience. Policymakers must promote diversified growth sectors, strengthen financial regulation, and encourage innovation in monetary and fiscal policies.

Building investor confidence through consistent policy signals and robust governance will be key. The liquidity trap is not merely a temporary monetary issue but a broader economic challenge that demands holistic and sustained responses.

Mauritius’s future financial stability hinges on decisive actions today to overcome the liquidity trap and build a resilient, diversified economy.

How Investors Can Stay Informed

Investors and stakeholders should regularly follow official updates from the Bank of Mauritius and the Financial Services Commission. Staying informed about policy changes and economic indicators will enable better decision-making in this challenging environment.

Related Articles

For more on Mauritius’s economic landscape, see our detailed article on Mauritius tax treaty, which explores key international financial agreements affecting the country.

Detailed explanation of the Liquidity Trap concept and its impact on the economy.

Table of Contents

- What Is the Liquidity Trap and Why It Matters

- The BoM’s Controversial Rs 4 Billion Liquidity Injection

- The Domino Effect: How the Bramer Bank Collapse Triggered BAI’s Downfall

- Why Mauritius Faces a Unique Liquidity Trap Challenge

- Policy Responses: The BoM’s Struggle to Maintain Stability

- The Legal Controversy Surrounding Liquidity Support

- The Role of Government and Financial Regulators

- What the Future Holds: Breaking Free From the Liquidity Trap

Source: By mauritiustimes