Mobile Money Expansion: 5 Powerful Ways Driving Africa’s Financial Inclusion

Wave, a leading mobile money provider based in Senegal, has successfully secured a $137 million debt financing round aimed at accelerating its Mobile Money Expansion efforts and enhancing working capital across both existing and new African markets. This substantial funding injection marks a pivotal milestone in making affordable, low-cost financial services accessible to underserved populations across the continent. With this capital, Wave is poised to strengthen its infrastructure and expand its agent network to meet the rising demand for digital payment solutions.

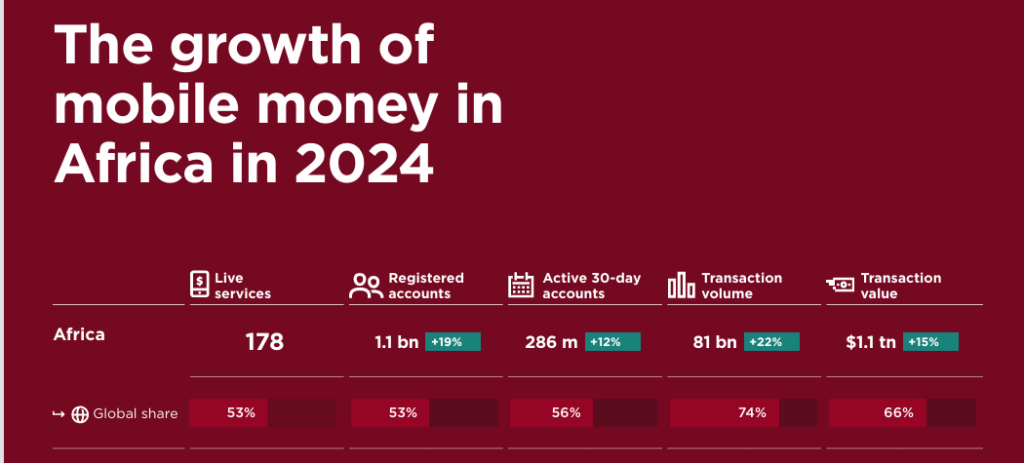

This funding round comes at a critical time when the African fintech sector is witnessing a surge in digital financial adoption. Mobile Money Expansion is increasingly recognized as a key driver for overcoming traditional banking barriers, offering individuals and businesses a simple, secure, and efficient way to conduct financial transactions using their mobile devices.

Why Mobile Money Expansion Is Key to Africa’s Growth

Africa’s population of over one billion faces significant challenges accessing formal financial services. A large percentage remain unbanked or underbanked, making Mobile Money Expansion crucial for achieving greater financial inclusion. Mobile money services enable users to perform banking activities conveniently from their phones without relying on physical bank branches.

Beyond individual benefits, Mobile Money Expansion empowers small and medium-sized enterprises (SMEs) by facilitating faster, cheaper payment and collection processes. This drives business growth and stimulates local economies. Moreover, digital transactions reduce the risks associated with cash handling, such as theft and fraud.

Furthermore, this expansion generates new employment opportunities by creating extensive agent networks and investing in digital infrastructure, providing youth and women with new avenues for economic participation.

How Wave’s $137M Debt Round Accelerates Mobile Money Expansion

The funding round was led by Rand Merchant Bank (RMB), with participation from development finance institutions including British International Investment (BII), Finnfund, and Norfund. This financial backing equips Wave with critical resources to scale operations and improve working capital, enabling expansion into new territories and underserved regions.

With this support, Wave plans to enhance service quality and develop innovative digital financial products like lending and savings solutions that better meet user needs. Investments in technology will also focus on increasing transaction security and service reliability.

This debt financing underscores investor confidence in Wave’s ability to lead Mobile Money Expansion and generate significant socio-economic impact across Africa in the coming years.

Wave’s Network and Its Impact on African Markets

Currently operating in eight West African countries, Wave serves over 20 million monthly users through a robust network of 150,000 agents and a workforce of 3,000 employees. By offering free deposits and withdrawals alongside a flat 1% fee for peer-to-peer transfers, Wave has successfully disrupted a sector traditionally dominated by telecom operators who charge fees as high as 10% per transaction. This customer-centric pricing model has made mobile money more affordable and accessible to millions across the region, fostering greater financial inclusion. Wave’s strategy not only reduces transaction costs but also encourages wider adoption of digital financial services among underserved populations, transforming the payment landscape in West Africa.

This expansive network allows users to conduct financial transactions with ease and confidence, significantly accelerating economic growth, particularly in previously underserved and rural regions. Beyond basic mobile money services, Wave offers innovative solutions such as bill payments, cross-border transfers, and integrated e-commerce platforms, enabling users to manage their financial lives more effectively. These additional services help bridge gaps in traditional banking infrastructure, making financial services more inclusive and responsive to the needs of African consumers. Wave’s continued expansion promises to unlock new opportunities for economic empowerment and digital transformation across the continent.

Challenges Facing Mobile Money Expansion and Wave’s Strategic Solutions

Despite remarkable progress in the African fintech landscape, several significant challenges still hinder the full potential of Mobile Money Expansion in Africa. Key issues include the limited availability of reliable digital infrastructure, especially in remote and rural areas, which restricts access to mobile financial services for large segments of the population. Additionally, the absence of uniform regulations and standards across different African countries complicates seamless cross-border money transfers. Another critical challenge is building and maintaining trust among new and existing users who may be wary of digital transactions due to concerns about security and fraud risks. Overcoming these obstacles is essential for accelerating financial inclusion across the continent.

Wave actively addresses these challenges by investing heavily in cutting-edge technology platforms that enhance transaction security and network reliability. The company also implements comprehensive educational programs targeting both users and agents, aiming to increase awareness of the benefits of mobile money as well as the potential risks involved. Moreover, Wave collaborates closely with governments, regulators, and other stakeholders to develop enabling regulatory frameworks that foster innovation in fintech while ensuring consumer protection. These strategic partnerships help create a supportive environment for Mobile Money Expansion in Africa, driving inclusive growth and economic empowerment across underserved communities.

Additionally, Wave prioritizes enhancing customer experience through advanced support services, promoting loyalty and sustainable growth.

For more detailed insights into the rapid growth of mobile money services in Africa and its economic impact, the World Bank’s Digital Financial Services overview offers comprehensive research and data. This resource highlights how initiatives like Wave’s Mobile Money Expansion align with broader continental efforts to promote financial inclusion through innovative technologies.

Future Opportunities in Mobile Money Expansion

The Mobile Money Expansion wave opens promising opportunities for Africa’s inclusive financial future. As user numbers grow and technologies evolve, demand for innovative financial services like digital lending, insurance, and savings is expected to rise significantly.

This expansion will bolster the digital economy, create new jobs, especially for youth and women, and support startups and entrepreneurs. It also contributes to financial stability by reducing cash dependency and improving transaction transparency.

Projections indicate Mobile Money Expansion will play a pivotal role in achieving Africa’s sustainable development goals by providing comprehensive financial services that support inclusive economic growth.

How Readers Can Benefit from Mobile Money Expansion

Investors and entrepreneurs can capitalize on the growing Mobile Money Expansion market by staying informed about sector developments and engaging with innovative projects. Individuals can leverage these services to simplify daily financial transactions and reduce costs related to transfers and payments.

We recommend readers explore financial reports and specialized studies to deepen their understanding of this dynamic market. For more insights on digital financial growth in Africa, visit our related article on Africa’s Fintech Growth.

Table of Contents

- Why Mobile Money Expansion Is Key to Africa’s Growth

- How Wave’s $137M Debt Round Accelerates Mobile Money Expansion

- Wave’s Network and Its Impact on African Markets

- Challenges Facing Mobile Money Expansion and Wave’s Strategic Solutions

- Future Opportunities in Mobile Money Expansion

- How Readers Can Benefit from Mobile Money Expansion

Source: By Fintech News Africa